2024

MGA Systems: fueling the insurance industry’s innovation engine

Entrant

Vertafore

Category

Business Technology Solutions - Insurance Solution

Client's Name

Country / Region

United States

Vertafore is North America’s InsurTech leader, serving more independent insurance agencies, carriers, and managing general agencies (MGAs) than any other technology provider. Vertafore’s solutions empower customers to modernize processes to improve the speed and quality of insurance distribution so they can spend more time serving as risk advisors/client champions.

MGAs specialize in connecting insurance companies with niche markets, acting as wholesalers who underwrite, bind, and manage insurance policies on behalf of insurers. They are also on the forefront of insurance, developing new lines of business for emerging coverage needs.

The MGA sector within the insurance distribution channel is experiencing tremendous growth—reflecting its position as the industry’s innovation engine. MGAs need fast, flexible solutions to make informed risk and pricing decisions, and that can keep pace as they expand into new specialized lines of business and retain their current customers.

Generalized software can’t service MGAs’ complex business models. MGAs need to make their operations as efficient as possible while having the flexibility to quickly respond to market needs. Acquired by Vertafore in 2022, MGA Systems was designed specifically for program administrators and MGAs. The solution empowers brokers to introduce new products and lines of business quickly, and to scale and adapt as business grows so they can immediately start building revenue.

MGA Systems is a customizable platform that gives users access to policy administration and rating solutions. Customizable features include:

• Accounting: Includes payables, receivables, invoicing, commissions, bank management, and billing. The module includes support for foreign currency.

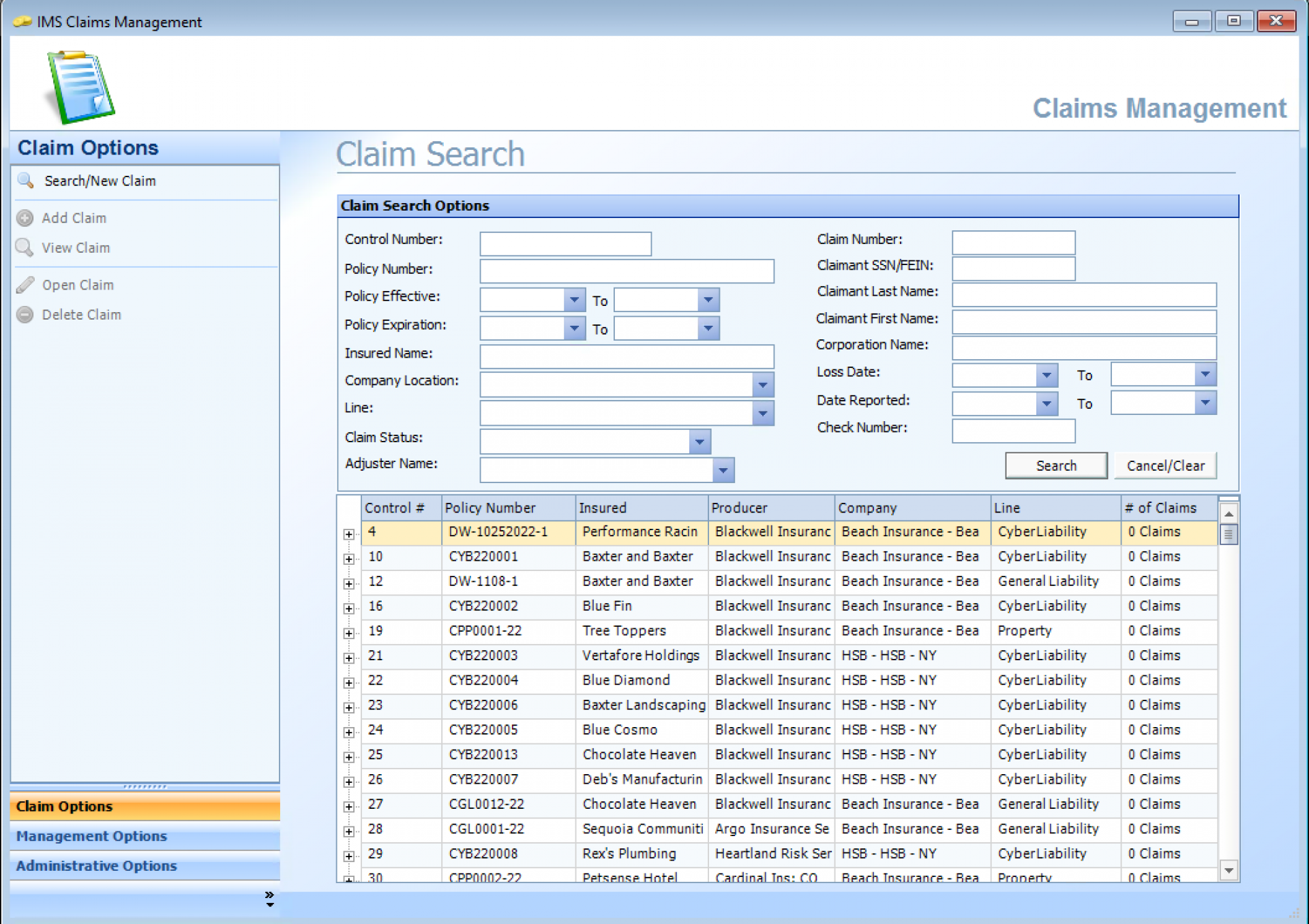

• Claims management: Integrated into the policy management and accounting systems which enables checks and balances against deductibles and limits. The web-based API for claims allows client customization and integration with external systems.

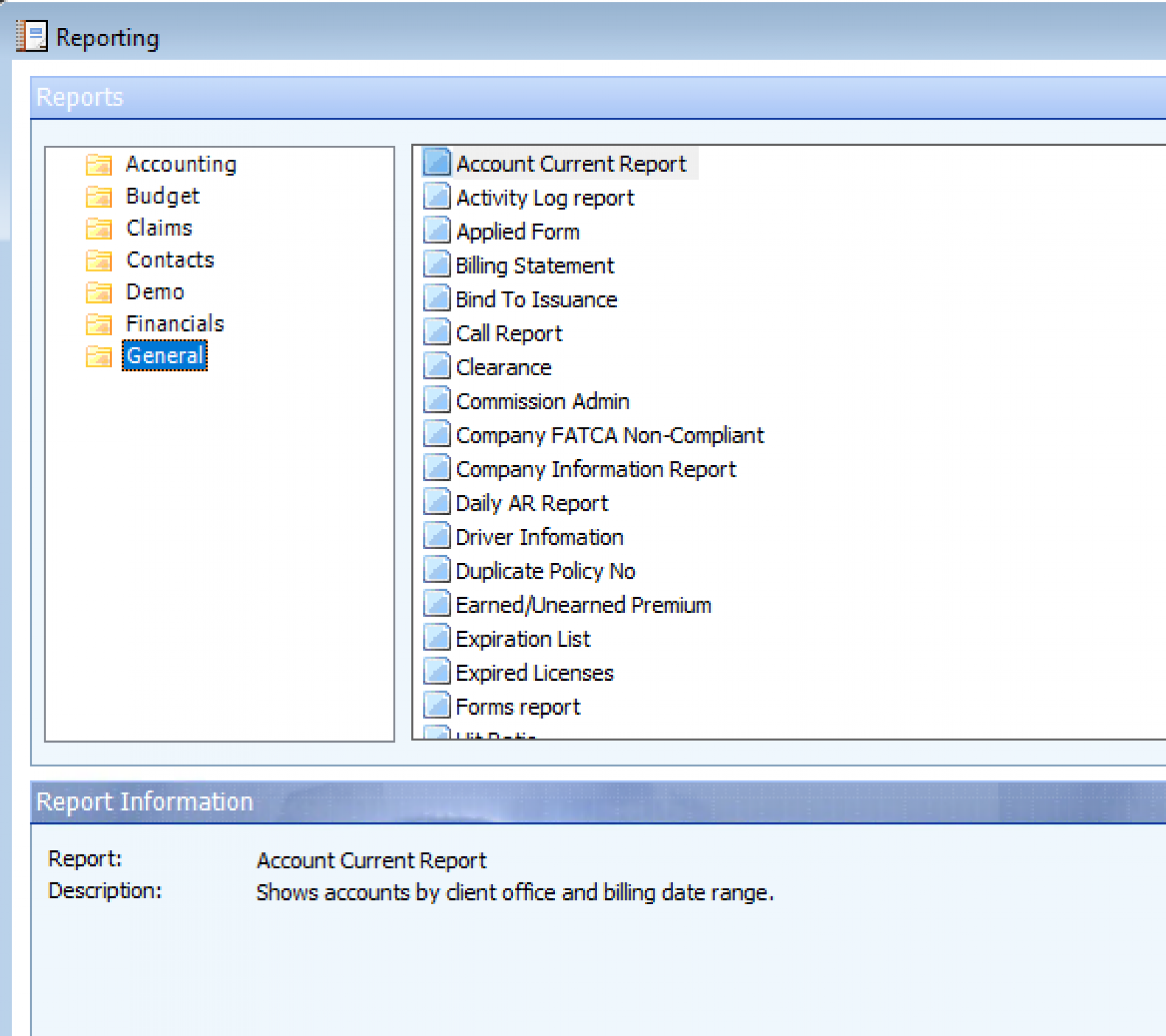

• Reporting: Easily extract the data to effectively run business

• Flexible technology: Open APIs allow easy integration with online portals, rating platforms, and other third-party applications.

• Security: Client server based with secure database connectivity for remote users.

Entrant

The Connor Group

Category

Company & Organization - Business of the Year

Country / Region

United States

Entrant

TRUGlobal

Category

Business Technology Solutions - Best Technical Support Strategy & Implementation

Country / Region

United States

Entrant

Sai Sharanya Nalla

Category

Information Technology - Artificial Intelligence

Country / Region

United States

Entrant

Milestone

Category

Product & Services - Law & Legal Services

Country / Region

United States